Published June 15, 2016 by Al Arabiya English

http://english.alarabiya.net/en/business/economy/2016/06/13/Future-of-Saudi-US-joint-business-opportunities-in-spotlight.html

Future of Saudi-US joint business opportunities in spotlight

by Patrick W. Ryan

Special to Al Arabiya EnglishWednesday, 15 June 2016

The commercial relationship between Saudi Arabia and the United States is among the important issues being discussed as Deputy Crown Prince Mohammed bin Salman is visiting Washington this week to meet with senior US leaders.

Prince Mohammed holds portfolios as Defense Minister and as head of the Council of Economic and Development Affairs, the leading body shaping the Kingdom’s economic reform program.

Many eyes will be on the conversations Prince Mohammed has with high-level US officials concerning the landmark transformation, Vision 2030, that was announced in April and has his direct imprint on it, and how that will affect Saudi-US business opportunities.

Prince Mohammed, or MBS as he is known, will travel to New York and California during his United States visit where he is expected to have conversations with finance, investment and technology leaders.

The prospects for expanding business will be examined with both sides looking for trade and investment opportunities.

Foreign direct investment

For American investors that will come in two parts, according to Richard Wilson, who heads the Saudi-US Trade Group (SUSTG) in Washington.

“There’s the immediate opportunity that is presented by the prospect of the privatization, an IPO, of some part of Saudi Aramco. You will see investment houses actively pursuing that opening. They are also treating the new Saudi economic program as a potential entree into other investment opportunities in the Kingdom.”

Saudi Deputy Crown Prince Mohammed bin Salman introduces Saudi Vision 2030 during a press conference. (SPA)

There are longer-term considerations as well, said Wilson: “Fortune 500 companies are looking at how regulatory reforms are going to affect their ability to invest in key sectors within the Kingdom. They are asking what changes will there be in terms of ownership requirements and the full array of business considerations large companies think about when they look to invest in Saudi Arabia.”

It is expected that MBS’s visit will be closely watched by US businesses to better understand what Saudi Arabia is going to prioritize in terms of foreign direct investment opportunities.

SUSTG’s Wilson said: “Investors are intrigued and curious but there has to be a wait and see attitude because investments at this level are scrutinized both on the legal side and on the business side. When you invest you want to make sure you have a firm grasp on the regulatory environment and the full terms of getting in and getting out.”

American business leaders, however, are sold that there’s a real intent in Saudi Arabia to change, to reform the economy and to take significant measures leading to a diversified economy. According to Wilson, “They’re excited that there’s someone, in the person of Prince Mohammed, who is very focused on achieving this goal and he appears to have sufficient influence and leverage to accomplish it.”

The Vision 2030 initiative and its implementing programs as they are detailed and launched have been very well received by businesses globally, from CEOs to economists, as signaling the Kingdom is moving in the right direction.

That has stimulated a great deal of curiosity and interest resulting in prospects for greater levels of foreign direct investment and it will significantly increase US involvement as Saudi Arabia moves along this path. In the visits to New York City and the West Coast, Prince Mohammed will likely look for feedback, interest and involvement in the Vision 2030 economic goals.

Uber deal and commercial ties

The Saudi Public Investment Fund’s (PIF) recent record-breaking $3.5 billion purchase of a major stake in the privately-held revolutionary car service Uber, has raised the profile of deals originating in the Kingdom. It signaled the intent to be an active player in markets for technology firms and investment opportunities across the board, according to Wilson.

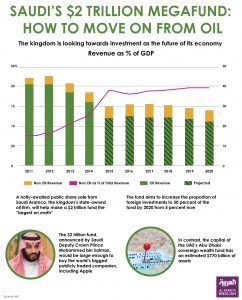

Infographic: Saudi’s $2 trillion megafund: How to move on from oil. (Farwa Rizwan/ Al Arabiya English) – Click for larger image.

“Saudis certainly want to diversify their investments so you can expect as they build the PIF they’ll be looking for those varied types of investments.” He added, “If you’re a potential target you can go and talk to the PIF as Uber did and make your pitch.”

The generations-old Saudi-US commercial relationship that Prince Mohammed looks to expand has grown on the shoulders of numerous public and private initiatives, trade delegations and investment resources.

In January, the US-Saudi CEO Summit program was launched at a conference in Riyadh through the efforts of the US Chamber of Commerce and the Saudi Chambers of Commerce and Industry.

Wilson, who attended the summit, said: “There’s a very good working relationship between the US Chamber of Commerce, the largest business association in the US and the Saudi Chambers of Commerce, it’s counterpart in Saudi Arabia.”

He noted the initiative is supportive of the new economic initiatives in the Kingdom and assists US business in becoming connected to new opportunities.

At the January summit, Thomas Donohue, head of the US Chamber said: “There are incredible opportunities for competitive American companies to bring their technology, knowledge, and financing to the Kingdom and to partner with and support key Saudi companies.”

________

Patrick W. Ryan is a Nashville-based consultant and analyst of Middle East affairs.

Last Update: Wednesday, 15 June 2016 KSA 11:09 – GMT 08:09